Men’s Wearhouse apparently didn’t like the way it looked, because its parent Tailored Brands filed for bankruptcy on Sunday. The California-based retail holding company also owns Jos. A. Bank and K&G Fashion.

💎 Data Digs

With Tailored Brands planning to close 500 of its stores, here’s our map showing the retail footprint for its major brands. The closures could impact REITs as well. Ramco-Gershenson Properties Trust and Shopping Center Group for example each own one Men's Wearhouse location.

Men's Wearhouse isn't just shrinking its store count. In the past year, the number of Men’s Wearhouse employees on LinkedIn fell by 3.7%.

🔬 Failure Blueprint

-

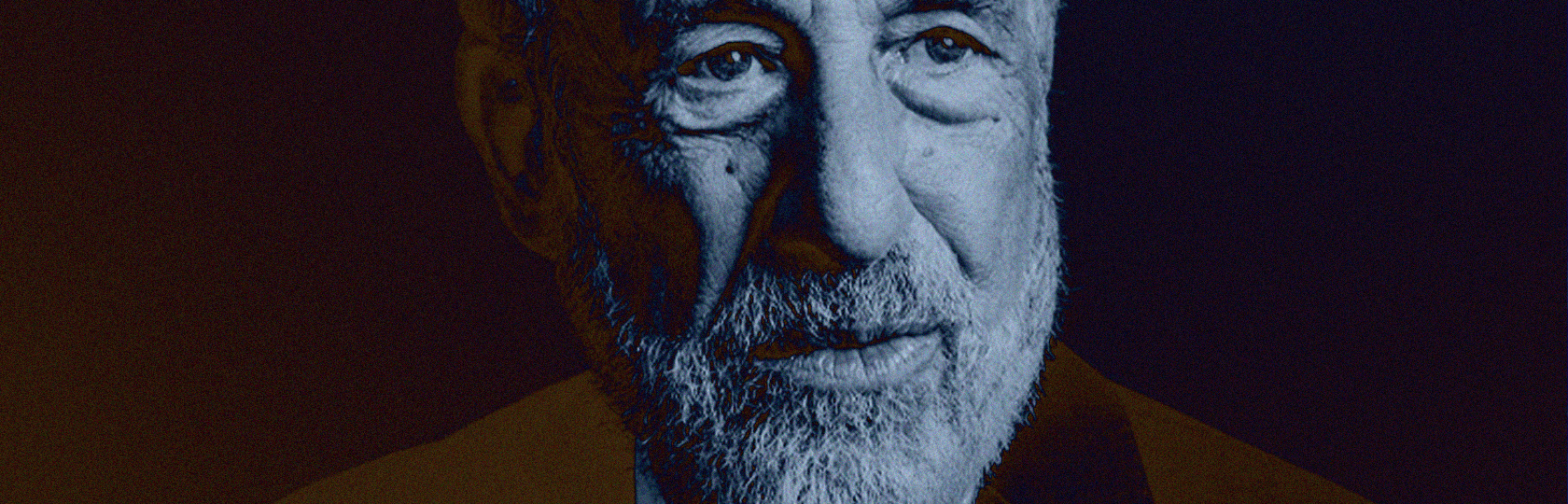

Unlike its suits, Men’s Wearhouse hasn’t looked sharp since 2013. That was when the company abruptly ousted founder and Executive Chairman George Zimmer. The exit of Zimmer was the first domino to fall as the company pursued a strategy built on racking up debt.

-

Similar to other recent retail collapses, the fingerprints of private equity are all over this one. Men’s Wearhouse merged with Jos A. Bank in 2014 with private equity firms influencing the debt-based deal. A 2019 study from California State Polytechnic University found that leveraged buyouts increase the chance of bankruptcy.

-

The newly-merged company struggled to compete against e-commerce competitors and failed to stay relevant in the age of relaxed office dress codes.

- The final death knell was the pandemic, which shuttered stores. In May, the company reported $1.4 billion in long-term debt and a 60.4% decline in sales.

- By July, Tailored Brands missed a $6 million interest payment and announced a 20% corporate workforce reduction.

⚡ Opportunity

Nimble e-commerce players who have embraced technology are bound to fill the void left by the demise of Men’s Wearhouse. That includes two startups launched by Zimmer, ZTailors (the Uber of tailoring) and Generation Tux (an online suit rental store).

It turns out that Zimmer might get the last laugh after all, or as he used to put it: “I guarantee it.”