Welcome to another edition of Business Twitter, where we collect the best tweets to come out of Silicon Valley so you don’t have to. This article is part of a newsletter — if you want a weekly Business Twitter roundup sent to your inbox, subscribe here.

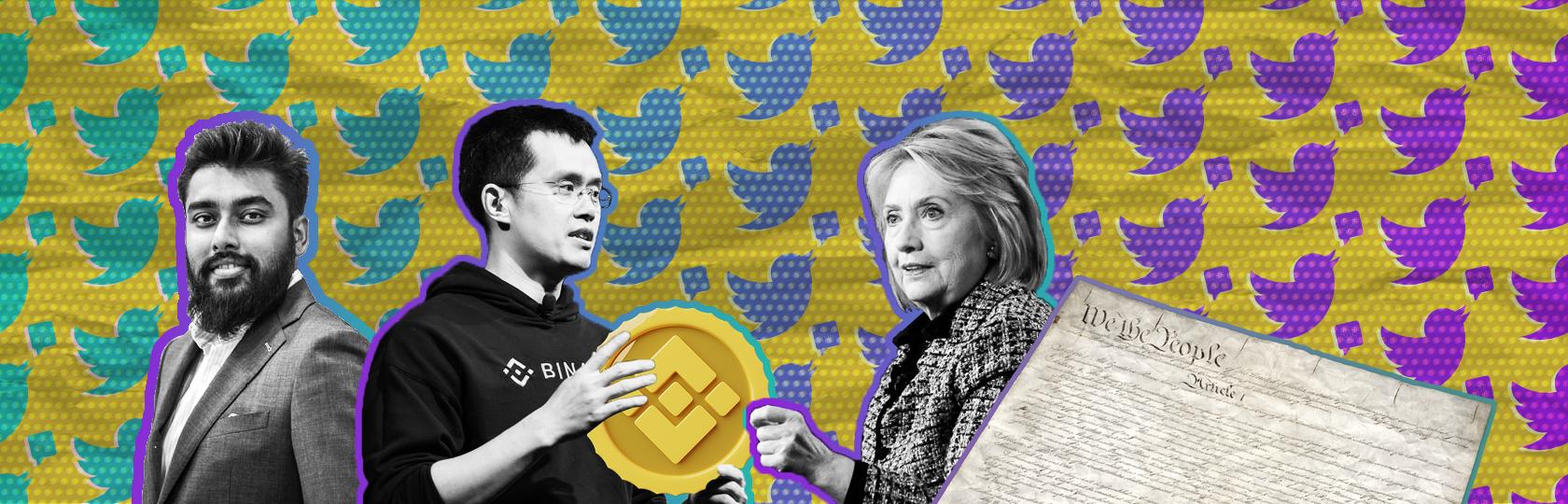

This edition: Hillary Clinton splashes ice water on the crypto inferno by explaining exactly why governments tend to be so averse to digital currency; a DAO raised more than $40 million to buy a first printing of the Constitution but was outbid by Ken Griffin; VCs try to explain Web3; and Silicon Valley fights back after Reuters runs an expose on Vignesh Sundaresan, aka MetaKovan.

“You can’t handle the truth.”

Government officials talk a good game about being supportive of technological innovation, and along with that, cryptocurrency. Meanwhile, policy maneuvers and enforcement actions (such as the ongoing dispute between the U.S. Securities and Exchange Commission and XRP creator Ripple) suggest they feel otherwise.

For a moment, though, a person who served as a highly influential government figure for decades — former U.S. Secretary of State and two-time presidential candidate Hillary Clinton — pulled back the curtain and gave crypto fans a glimpse of what they’re really up against. Her comments sort of bring to mind Colonel Jessup in Aaron Sorkin’s A Few Good Men, dropping his pretense of cooperativeness while testifying during a trial and growling: “You can’t handle the truth!”

“What looks like a very interesting and exotic effort...has the potential for undermining currencies, for undermining the role of dollars as reserve currencies, for destabilizing nations…,” she said during the Bloomberg New Economy Forum. Her comments were tweeted by New York Times media columnist Ben Smith.

The now $3 trillion cryptocurrency market represents “a whole new layer of activity that could be extremely destabilizing or, in the wrong hands or in alliances with the wrong people, could be direct threats to many of our nation states and certainly to the global currency markets,” the former Democratic official continued.

She wasn’t wrong, according to Binance CEO Changpeng Zhao. Zhao told Smith, in comments that Smith tweeted: “I agree very much with her on the potential threat part, but my response is very different. It’s not a threat you can attack like terrorism. It’s a new tech innovation. There’s no way to fight it. You should embrace it, and own it.”

We don’t know if governments will ever broadly embrace the possible destabilizing elements of crypto (incoming NYC Mayor Eric Adam’s flirtation with bitcoin aside), but at least it’s clear those concerns are a pretty big obstacle in policy discussions.

ConstitutionDAO shows us the best way to lose an auction

If you don’t know what a “DAO” is by now, it’s too late to explain here. One already raised more than $40 million and tried to buy the Constitution.

ConstitutionDAO was founded over a Discord server by two 25-year-old financial workers as a joke after Sotheby’s announced it was auctioning off a rare first-run printing of the U.S. Constitution. Within days, the effort snowballed into a real thing, growing to 17,000 members and collecting tens of millions of dollars.

They fell short, however. In an amusing twist, hedge fund billionaire Ken Griffin bid just a little bit more than the DAO had to spend, and won the auction. Griffin’s Citadel was also at the center of another internet drama, when traders on WallStreetBets fueled a massive rally in GameStop back in January.

Perhaps a public crowdfunding campaign is not the best way to win an auction, as Vanessa Grellet, head of portfolio growth for Coinfund, pointed out.

“How to lose an auction,” Grellet tweeted. “1. Let everyone know you are bidding, 2. Let everyone know what your max budget is, 3. Wait for someone to bid your budget + dollar.”

The attempt did, however, massively raise awareness of DAOs and what sort of National Treasure-like heists they might accomplish. (So far, the only one that has actually happened, though, was a DAO buying a rap album for $4 million that used to belong to my ex-boyfriend.)

On balance, ConstitutionDAO viewed its effort as a success (it also promised all the contributors would get their ether back).

“We showed the world what crypto and web3, onboarding thousands of people in the process, including museum curators and art directors who are now excited to keep learning,” organizers of the DAO tweeted.

“We were the first DAO @Sothebys has ever worked with, but we're sure we won't be the last one.”

Literally everyone is trying to explain Web3

Speaking of Web3, we still don’t completely know what it is — but that’s not for lack of explanatory tweets and tweet threads from VC’s, writers and tech people on the subject. In short, we know it’s generally been called “the decentralized internet of the future.” Here are some of the more detailed descriptions served up via Twitter.

“Web3 is the best bridge between your social capital and financial capital,” Andreessen Horowitz general partner Sriram Krishnan tweeted. “You can quickly see people with strong social capital (trusted in communities) rewarded in ways that [weren’t] possible.”

Meanwhile, Motley Fool financial blogger Brian Feroldi tweeted a long thread promising “10 FREE resources that will help you get up to speed fast” on Web3, which appeared to be well-received.

Color Capital partner Chris Cantino did one better by not just describing web3, but also how to explain it (along with crypto and NFTs) to your friends and family “without overwhelming them.”

“Let’s begin with the most important principle: don’t be heavy-handed,” he added.

(We imagine this advice might be useful for Thanksgiving gatherings.)

Silicon Valley circles the wagons in defense of MetaKovan

This past week, Reuters published a lengthy investigative piece on Vignesh Sundaresan, also known as “MetaKovan,” a Singapore-based billionaire blockchain entrepreneur and angel investor. Sundaresan first rose to public attention when it was revealed that he was the buyer of Beeple’s record-setting $69 million NFT.

The Reuters piece took a critical look at Sundaresan, saying that he “trod a sometimes rocky path in accumulating his assets, leaving behind frustrated customers and investors who say they lost, in total, millions of dollars.”

The billionaire acknowledged in interviews with Reuters that he faced “setbacks” but said he never did anything wrong. “I would never do something to hurt someone financially,” he said.

Silicon Valley heavyweights lost no time in attacking the mainstream press over the article and defending Sundaresan. Prasanna Sankar, co-founder of HR platform Rippling, criticized the authors for publishing “a hit piece on my dear friend.” Retweeting Sankar, Y Combinator co-founder Paul Graham added:

“One of the biggest surprises of my adult life is how unethical reporters are. In movies they’re always the good guys. Everyone in tech knows stories like this.”