Yahoo Finance reported that Amazon ($AMZN) is eyeing shuttered Sears ($SHLD) and Kmart locations as potential sites for its Whole Foods supermarkets.

Whole Foods currently outpaces Trader Joe's ($PRIVATE:TRADERJOES) in terms of stores with 516 locations, but is losing to the likes of ALDI ($PRIVATE:PRIV_ALDI) and traditional supermarket giants such as Ahold Delhaize ($DEG).

Technically, Whole Foods could just dig deep into Amazon's pockets and buy out every plot of land that had a Sears and Kmart on it and quintuple its number of stores. Our database saw 2,602 Sears and Kmart locations close in the United States since we started tracking their store locations.

But realistically, Amazon wouldn't do that.

One of the biggest reasons why it wouldn't would be because of the demographics it is targeting, which it just-so-happens to lay out on its Real Estate page.

Essentially, Amazon wants to place stores in areas where there are plenty of people who have the money and are willing to spend $6 on asparagus water... If it still carried that product (that burn is brought to you by the year 2016).

All jokes aside, Whole Foods wants stores in populated areas where people have discretionary income thanks to jobs that require at least a bachelor's degree. So we uncovered the most-likely places where Whole Foods could turn an ex Sears or Kmart into a new market.

Browsing the selection

Whole Foods and Sears have two widely different strategies when it comes to figuring out where to settle, as seen through the average income by Core-Based Statistical Area of closed Sears and open Whole Foods.

| Store | Income by Core-Based Statistical Area** |

|---|---|

| Whole Foods | $65,429.65 |

| Closed Sears | $54,034.47 |

Unsurprisingly, the average Whole Foods sits in areas where the median income for households is more than double that of the 2016 national average. Sears, meanwhile, has several locations in lower income areas, such as in the Midwest and rural markets, which drive down its average.

**(Note: CBSA Data was not included from 51 out of 516 Whole Foods and 244 out of 2,602 closed Sears and Kmart Locations. Income data is from 2016.)

From here, we can narrow down where Whole Foods might set up shop by only plotting closed Sears and Kmart locations around or above the Whole Foods median income average, as well as all those who are at least in the ballpark of the minimum median income.

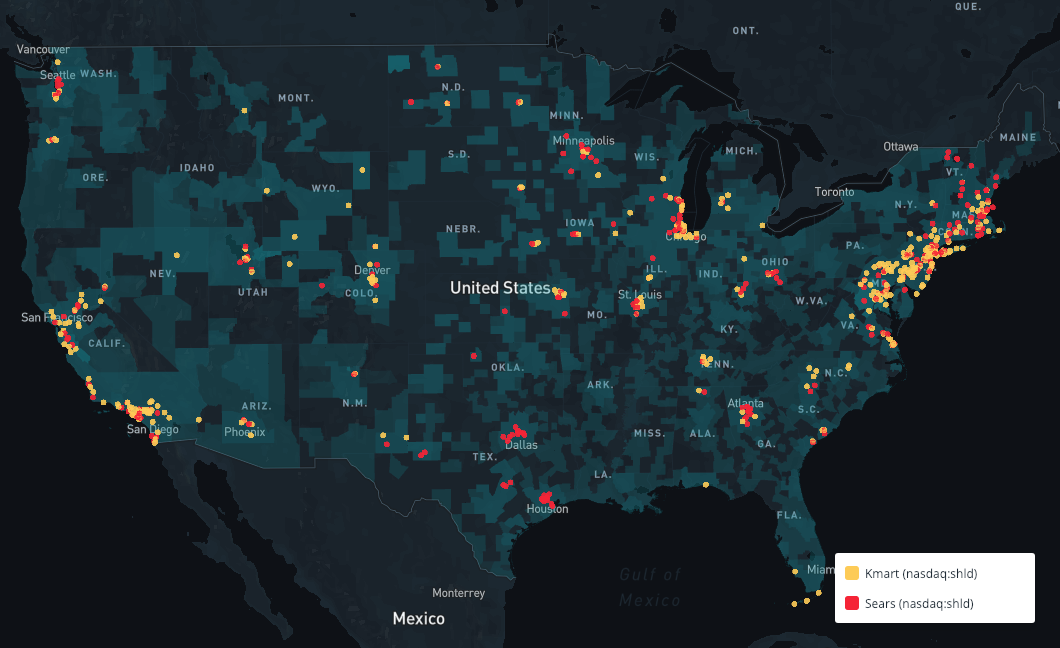

And here is a look at the 1,200+ closed stores in areas where the median income is at least $42,000, the income of the Whole Foods in the "poorest" CBSA (sorry, El Paso.)

(There area also some locations in Alaska and Hawaii too)

There are plenty of Sears locations in areas where Whole Foods has plenty of real estate already (New York, California, Seattle, etc.) However, overlaying the lifetime footprint of these two retailers shows a few areas where Whole Foods could branch out and set up shop. These places include North Dakota, Wyoming, and parts of upstate New York like Rochester.

(Note: Map includes open Sears and Kmart locations, as well as closed Whole Foods).

But what about square footage?

The square footage specifications do throw a small wrench into what former Sears and Kmart stores it would consider, as the average Sears or Kmart takes up about 68,000 square feet of space. But then again, Amazon could just sublet space to other tenants, break up their store to allow more tenants to rent directly, or just open up a megastore.